Thus, interim financial statements are prepared for management to check the status of operations during comparative financial statements the year. Management also typically prepares departmental statements that break down revenue and expense numbers by business segment. Unlike the balance sheet, the income statement calculates net income or loss over a range of time. For example annual statements use revenues and expenses over a 12-month period, while quarterly statements focus on revenues and expenses incurred during a 3-month period. An income statement (also called a profit and loss statement, or P&L) summarizes your financial transactions, then shows you how much you earned and how much you spent for a specific reporting period. In this guide we’ll use annual reports as examples, but you can prepare income statements quarterly or monthly as well.

Operating Income represents what’s earned from regular business operations. In other words, it’s the profit before any non-operating income, non-operating expenses, interest, or taxes are subtracted from revenues. EBIT is a term commonly used in finance and stands for Earnings Before Interest and Taxes. Single-step income statement – the single step statement only shows one category of income and one category of expenses. This format is less useful of how to start a bookkeeping business in 2021 external users because they can’t calculate many efficiency and profitability ratios with this limited data.

It’s frequently used in absolute comparisons but can be used as percentages, too. Next, $560.4 million in selling and operating expenses and $293.7 million in general administrative expenses were subtracted. To this, additional gains were added and losses subtracted, including $257.6 million in income tax. The income statement calculates the net income of a company by subtracting total expenses from total income. retained earnings calculation This calculation shows investors and creditors the overall profitability of the company as well as how efficiently the company is at generating profits from total revenues.

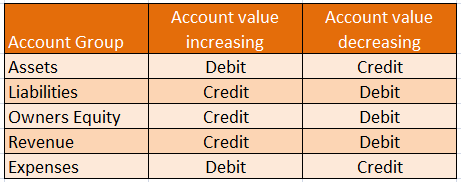

Data Tables

Competitors also may use income statements to gain insights about the success parameters of a company, such as how much it is spending on research and development. If total revenue minus total operating expenses is a negative number, this is considered an operating loss. The company received $25,800 from the sale of sports goods and $5,000 from training services for a total of $30,800 in revenue. Use one of our templates to list the sales, expenses, and other gains or losses in the correct format. At the bottom of the statement, compute the net income for the company. In both income statement formats, revenues are always presented before expenses.

Your income statement follows a linear path, from top line to bottom line. Common size income statements include an additional column of data summarizing each line item as a percentage of your total revenue. If your business owes someone money, it probably has to make monthly interest payments. Your interest expenses are the total interest payments your business made to its creditors for the period covered by the income statement.

Sure, a glance at your income statement may tell you how much you’ve spent in a certain period of time, and how much your business has made. But once you learn how all the different line items interact, and what they mean for your company’s financial performance, you’ll be better able to troubleshoot, fine tune, and plan your day-to-day operations. An income statement is a financial statement that reports the revenues and expenses of a company over a specific accounting period. Also known as profit and loss (P&L) statements, income statements summarize all income and expenses over a given period, including the cumulative impact of revenue, gain, expense, and loss transactions. Income statements are often shared as quarterly and annual reports, showing financial trends and comparisons over time. However, real-world companies often operate on a global scale, have diversified business segments offering a mix of products and services, and frequently get involved in mergers, acquisitions, and strategic partnerships.

- The other two key statements are the balance sheet and the cash flow statement.

- By conducting a horizontal analysis, you can tell what’s been driving an organization’s financial performance over the years and spot trends and growth patterns, line item by line item.

- Gross Profit Gross profit is calculated by subtracting Cost of Goods Sold (or Cost of Sales) from Sales Revenue.

Step 2 of 3

Learn to analyze an income statement in CFI’s Financial Analysis Fundamentals Course. Gross Profit Gross profit is calculated by subtracting Cost of Goods Sold (or Cost of Sales) from Sales Revenue. Automating data entry processes and conducting regular audits can help reduce manual data entry errors like duplication and omissions. It’s important to do monthly account reconciliations to maintain data integrity and ensure financial records are accurate and follow the rules.

Total Revenue (aka Total Sales, Sales Revenue, Gross Revenue)

But if you’re looking for a super simple financial report to calculate your company’s financial performance, single-step is the way to go. Multi-step income statements separate operational revenues and expenses from non-operating ones. They’re a little more complicated but can be useful to get a better picture of how core business activities are driving profits. An income statement is a financial statement that lays out a company’s revenue, expenses, gains, and losses during a set accounting period. It provides valuable insights into various aspects of a business, including its overall profitability and earnings per share. Creditors are often more concerned about a company’s future cash flows than its past profitability.

These two calculations are best shown on a multi-step income statement. Gross profit is calculated by subtracting cost of goods sold from net sales. Operating income is calculated by subtracting operating expenses from the gross profit. Along with balance sheets and cash flow statements, income statements are one of the three financial statements essential for measuring your company’s performance. The single-step format is useful for getting a snapshot of your company’s profitability, and not much else, which is why it’s not as common as the multi-step income statement.